Travel insurance in Oman is often treated as an optional extra rather than an essential part of travel planning. But have you ever asked yourself what would happen if you suddenly fell ill abroad, missed a connecting flight, or lost your baggage in a foreign airport? Many travelers focus heavily on booking flights and hotels while assuming nothing will go wrong. Unfortunately, unexpected events are more common than people think, and the financial impact can be significant.

Why do so many travelers hesitate to purchase insurance? Travel insurance in Oman: Is it the cost, the confusing policy terms, or the belief that “it won’t happen to me”? The reality is that travel insurance does not have to be expensive or complicated. In fact, with the right knowledge, you can secure reliable coverage at a very reasonable price while still protecting yourself from major financial risks.

This comprehensive guide is designed to help you understand how to find affordable and reliable travel insurance options tailored to Oman. Whether you are a tourist visiting the country or a resident traveling abroad, this article will walk you through coverage types, cost-saving strategies, and common mistakes to avoid. By the end, you will be equipped to make a confident and informed decision without overspending.

Understanding Travel Insurance: What Does It Really Cover?

Travel insurance is more than just a safety net—it is a financial shield against unpredictable events. While coverage varies between providers, most policies are built around several core protections that every traveler should understand.

Medical Expenses and Emergency Treatment

One of the most critical benefits of travel insurance is medical coverage. Healthcare costs abroad can be extremely high, especially in emergencies. Insurance typically covers:

Hospitalization and emergency medical treatment

Doctor consultations and prescribed medications

Emergency dental care due to accidents

Without proper coverage, even a minor medical issue can result in thousands of dollars in expenses.

Emergency Medical Evacuation and Repatriation

Travel insurance in Oman. In severe cases, travelers may need transportation to another medical facility or even back to their home country. This is where emergency evacuation coverage becomes essential. Such services are extremely expensive without insurance and are often overlooked by first-time travelers.

Lost, Delayed, or Damaged Baggage

Airline delays and baggage mishandling are common travel issues. Travel insurance can compensate you for:

Lost personal belongings

Delayed baggage requiring emergency purchases

Damaged items during transit

This benefit is especially useful for long-haul or multi-stop journeys.

Why Travel Insurance Is Essential for Oman-Based Travelers

Oman is a growing travel hub, attracting tourists and business travelers alike. At the same time, many residents of Oman travel frequently for work, leisure, or education. This makes travel insurance a necessity rather than a luxury.

- Rising Medical Costs Abroad

Healthcare systems vary widely from country to country. Travelers from Oman may find themselves in destinations where medical care is not subsidized or affordable. International medical expenses can escalate rapidly without warning.

- Visa and Entry Requirements

Some countries require proof of valid travel insurance before granting a visa. In such cases, insurance is not optional—it is mandatory. Having a suitable policy avoids visa delays or rejections.

- Protection Against Travel Disruptions,

Travel insurance in omanFlight cancellations, political unrest, natural disasters, and airline strikes can disrupt travel plans. Insurance offers financial protection and assistance services when such disruptions occur unexpectedly.

Key Factors That Affect the Cost of Travel Insurance

Understanding what influences insurance pricing is the first step toward finding the cheapest option without compromising coverage.

- Destination and Duration of Travel

Longer trips generally cost more to insure. Similarly, destinations with higher healthcare costs or increased risk levels may lead to higher premiums. Short trips within low-risk regions are usually cheaper to insure.

- Traveler’s Age and Health Condition

Age is a major pricing factor. Older travelers typically pay more due to higher medical risk. Pre-existing medical conditions may also increase costs or require special coverage options.

- Level of Coverage and Policy Limits

Basic plans are cheaper but offer limited benefits. Comprehensive plans cost more but provide higher coverage limits and additional protections. Choosing only what you need is key to saving money.

Types of Travel Insurance Plans Available

Choosing the right plan type can significantly reduce unnecessary expenses while ensuring adequate protection.

- Single-Trip Insurance

This plan is ideal for travelers taking one trip per year. It covers a specific journey and ends when you return home. It is often the cheapest option for occasional travelers.

- Multi-Trip or Annual Insurance

Frequent travelers benefit from annual plans that cover multiple trips throughout the year. While the upfront cost is higher, it can be more economical over time.

- Family and Group Plans

Traveling with family or a group? Group policies often offer discounted rates compared to purchasing individual plans for each traveler.

Common Mistakes Travelers Make When Buying Insurance

Many travelers end up paying more—or getting less coverage—due to avoidable mistakes.

- Choosing the Cheapest Policy Without Reading Details

Low-cost policies may come with exclusions, low coverage limits, or high deductibles. Always understand what is included and excluded.

- Ignoring Pre-Existing Conditions

Failing to declare medical conditions can result in claim rejection. Transparency is essential when purchasing insurance.

- Overlooking Policy Exclusions

Activities such as adventure sports or certain destinations may not be covered under standard policies. Always check exclusions carefully.

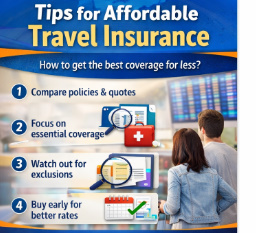

How to Compare Travel Insurance Plans Effectively

To find the cheapest and most suitable plan, comparison is crucial.

Compare Coverage, Not Just Price

A slightly higher premium may offer significantly better benefits. Look at:

Medical coverage limits

Emergency assistance services

Claim settlement reputation

Understand Deductibles and Co-Payments

Lower premiums often come with higher deductibles. Make sure you are comfortable with out-of-pocket costs in case of a claim.

Check Customer Support and Claims Process

travel insurance in oman, Efficient customer service and a simple claims process can save time and stress during emergencies.

Family emergencies

Airline cancellations

Natural disasters

Understanding these conditions helps travelers avoid denied claims.

What Is Commonly Excluded?

Not all reasons qualify for reimbursement. Common exclusions include:

Change of mind

Known events before booking

Travel against medical advice

Always read the fine print to avoid misunderstandings.

How Claims Work: What You Should Know Before Traveling

Many travelers only learn about claims when it is too late. Understanding the process in advance can save stress and time.

Documentation Is Everything

Successful claims depend on proper documentation, such as:

Medical reports

Police reports for theft

Airline delay confirmations

Keeping digital copies of documents is highly recommended.

Timelines Matter

Travel insurance in Oman, Most insurers require claims to be submitted within a specific timeframe. Missing deadlines can result in claim rejection, regardless of validity.

Partial vs Full Reimbursement

Some expenses may be reimbursed partially based on policy terms. Knowing these limits helps set realistic expectations.

Comparing Insurance Plans: What to Look for Beyond Price

While price matters, other factors often determine whether a policy truly delivers value.

- Reputation and Reliability

Choosing providers with strong customer support and transparent policies ensures smoother assistance during emergencies. Travel insurance in Oman. This is why evaluating the best insurers in Oman is essential when comparing options.

- 24/7 Emergency Assistance

Access to round-the-clock support is critical, especially when traveling across time zones. Emergency hotlines and multilingual support can make a major difference.

- Flexibility and Customization

Some policies allow travelers to adjust coverage levels. This flexibility helps reduce costs while maintaining essential protection.

Special Considerations for Medical Coverage

travel insurance in oman, travel insurance in Oman, Medical benefits are often the most important part of any travel insurance policy.

Pre-Existing Medical Conditions

Not all policies automatically cover pre-existing conditions. Some may require:

Medical screening

Additional premiums

Coverage limitations

Being honest during the application is crucial to avoid claim denial.

Coverage for High-Risk Activities

Activities like diving, hiking, or adventure sports may not be included in standard plans. Travelers engaging in such activities should ensure that activity-specific coverage is included.

Cost-Saving Tips Most Travelers Don’t Know

Small decisions can lead to meaningful savings without reducing protection.

Choose higher deductibles to lower premiums

Avoid overlapping coverage from credit cards

Skip coverage you already have through employer benefits

Compare policy features instead of brand names

These strategies help travelers secure affordable insurance without unnecessary compromises.

Frequently Asked Questions (FAQ)

Q1: Is travel insurance mandatory when traveling from Oman?

In some destinations, proof of insurance is required for visa approval. Even when not mandatory, it is strongly recommended for financial protection.

Q2: Can I buy travel insurance after booking my flight?

Yes, but buying early often provides better benefits, including broader cancellation coverage.

Q3: Does travel insurance cover COVID-19-related issues?

Coverage varies by policy. Some plans include medical treatment and trip disruptions related to pandemics, while others exclude them.

Q4: Can I extend my insurance while already traveling?

Some insurers allow extensions, but approval depends on policy terms and travel status.

Q5: What happens if my claim is denied?

Claims may be denied due to missing documents, excluded events, or incorrect information. Reviewing policy terms carefully reduces this risk.

Final Thoughts

Choosing the right travel insurance is about preparation, not fear. Travel insurance in Oman. By understanding coverage options, identifying real risks, and comparing plans wisely, travelers can secure affordable protection without unnecessary expenses. The cheapest policy is not always the best—but the smartest one always is.

Taking the time to plan today can protect your finances, health, and peace of mind tomorrow. Explore your options carefully, choose coverage that fits your journey, and travel with confidence knowing you are protected.

Read also: Cheapest international money transfer from Saudi Arabia