Personal loan eligibility in Kuwait has become a major concern for individuals planning their finances in 2025. Are you wondering whether your salary is enough to qualify for a personal loan? Do banks apply the same rules for citizens and expatriates, or are there hidden conditions you should be aware of? With changing banking regulations and stricter credit policies, understanding how loan eligibility works is no longer optional—it is essential.

Many applicants feel confused when comparing loan offers from different banks. Some focus only on interest rates, while others overlook critical factors such as employment stability, length of residency, and debt obligations. Without clear knowledge, borrowers may face unexpected rejections or unfavorable loan terms. This is especially true for expatriates navigating Kuwait’s financial system for the first time.

In this comprehensive guide, we explain how personal loan eligibility in Kuwait works in 2025, what banks really look for, and how you can improve your chances of approval. Whether you are salaried, self-employed, or supporting a family, this article provides clear answers and practical insights to help you make informed financial decisions.

Understanding Personal Loan Eligibility in Kuwait

personal loan eligibility in kuwait, Personal loan eligibility in Kuwait is determined by a set of criteria established by banks and regulated by the Central Bank. These criteria aim to reduce financial risk while ensuring borrowers can repay their loans comfortably. Although policies may differ slightly from one bank to another, the core requirements remain largely consistent across the banking sector.

At its core, eligibility depends on your financial stability, employment status, and creditworthiness. Banks want assurance that borrowers have a reliable income source and a clean repayment history. In 2025, lenders are also placing greater emphasis on monthly debt-to-income ratio, ensuring borrowers are not overburdened by existing financial commitments.

Another key element is loan purpose transparency. While personal loans are flexible, banks still assess whether the requested amount aligns with the applicant’s income and financial profile. Borrowers requesting excessively high amounts without justification may face rejection or reduced approval.

Key Eligibility Criteria Set by Kuwaiti Banks

Minimum Salary Requirements

personal loan eligibility in kuwait, Salary remains one of the most decisive factors in loan eligibility. Most banks set a minimum monthly income threshold to ensure borrowers can meet repayment obligations without financial strain.

Key points banks evaluate include:

Net monthly income after deductions

Consistency of salary payments

Employer reliability and reputation

Higher salaries often result in:

Larger loan amounts

Longer repayment periods

More favorable interest rates

Employment Sector and Job Stability

Banks in Kuwait classify employers into different categories based on stability and risk. Applicants working in government entities, oil and gas companies, or large private corporations usually enjoy better loan terms.

Important employment factors include:

Length of service with current employer

Employment contract type (permanent vs. temporary)

Industry risk level

Applicants with less than one year of employment may face stricter conditions or delayed approval.

Citizens vs. Expatriates: Eligibility Differences

While both citizens and expatriates can apply for personal loans, banks apply different risk assessments. For expatriates, eligibility is closely tied to residency validity and employment continuity.

Banks typically assess:

Remaining residency duration

Passport validity

Employer sponsorship

Personal loan eligibility in Kuwait, Expatriates working in high-demand sectors with stable employers generally have stronger approval chances. In contrast, short-term contracts or frequent job changes can negatively impact eligibility.

Age Limits and Loan Tenure Rules

Age plays a crucial role in determining loan approval and repayment duration. Banks set minimum and maximum age limits to ensure borrowers can complete repayment within their working years.

Typical age guidelines include:

Minimum age at application: 21 years

Maximum age at loan maturity: 60–65 years

Applicants nearing retirement age may receive:

Shorter loan tenures

Lower approved amounts

Credit History and Financial Behavior

In 2025, banks rely heavily on credit records to evaluate borrower reliability. A strong credit profile demonstrates responsible financial behavior and timely repayments.

Banks analyze:

Previous loan repayment history

Credit card usage patterns

Missed or delayed payments

Negative credit records can:

Reduce loan amount eligibility

Increase interest rates

Lead to outright rejection

Maintaining a clean credit history is one of the most effective ways to improve approval chances.

Debt Burden Ratio Explained

One of the most important calculations banks perform is the debt burden ratio, which measures how much of your income goes toward existing obligations.

Banks prefer:

Monthly debt commitments below 40–50% of income

This ratio includes:

Existing loans

Credit card installments

Any recurring financial obligations

Applicants with high debt ratios may be asked to settle existing liabilities before approval.

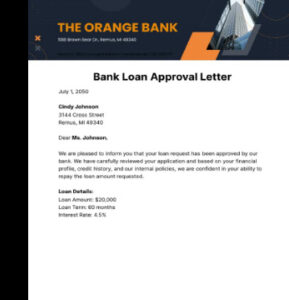

Required Documentation for Loan Applications

Accurate and complete documentation speeds up the approval process. Missing or inconsistent documents often lead to delays or rejection.

Commonly required documents include:

Civil ID copy

Salary certificate

Bank statements

Employment contract

Some banks may also request:

Employer authorization letters

Proof of address

Ensuring documents are up to date improves approval efficiency.

How Loan Amounts Are Calculated

Loan amounts are not arbitrary. Banks calculate eligibility based on income, tenure, and repayment capacity.

Key calculation factors include:

Monthly salary

Loan tenure length

Applicable interest rate

Applicants with stable employment histories and higher incomes generally qualify for higher amounts with flexible repayment terms.

Common Reasons for Loan Rejection

Understanding rejection reasons can help applicants avoid costly mistakes.

The most common causes include:

Insufficient salary

High existing debt

Poor credit history

Short employment duration

In some cases, incomplete documentation alone can result in rejection, even if financial eligibility is strong.

How to Improve Personal Loan Eligibility

Improving eligibility is possible with proper financial planning. Banks reward borrowers who demonstrate responsibility and stability.

Effective strategies include:

Reducing existing debts

Maintaining consistent employment

Improving credit behavior

Choosing realistic loan amounts

Small adjustments can significantly increase approval chances and lead to better loan terms.

Comparing Loan Options Available in Kuwait

Choosing the right personal loan option requires more than comparing interest rates. Borrowers must evaluate eligibility conditions, repayment flexibility, and long-term financial impact. Banks in Kuwait structure their personal loan products to suit different income levels and employment sectors.

Key Factors to Compare Before Applying

When evaluating loan offers, applicants should focus on:

Approved loan amount based on salary

Repayment period flexibility

Fixed versus reducing interest structures

Early settlement conditions

A well-informed comparison prevents unexpected financial pressure later.

Personal Loan Eligibility by Employment Type

Government Sector Employees

Government employees often benefit from relaxed eligibility criteria due to job security and income stability. Banks consider this group low risk, which leads to:

Higher approval rates

Longer repayment tenures

Competitive interest rates

Private Sector Employees

Private sector applicants face stricter evaluation, especially in industries affected by market fluctuations. Banks closely review:

Employer classification

Length of service

Salary consistency

Applicants working with reputable companies enjoy better terms compared to those in smaller firms.

Self-Employed Individuals

Self-employed professionals must demonstrate stable income through:

Business bank statements

Trade licenses

Consistent revenue history

Although eligibility is possible, approval may involve stricter documentation and lower loan limits.

Salary Transfer and Its Impact on Eligibility

Salary transfer plays a significant role in loan approval decisions. Banks prefer applicants who agree to transfer their salary to the lending institution because it ensures direct repayment control.

Benefits of salary transfer include:

Faster approval process

Higher loan limits

Lower interest rates

Applicants unwilling to transfer salary may still qualify, but often under tighter conditions.

Understanding Interest Rates and Repayment Structures

Interest rates vary depending on borrower profile and risk level. In 2025, banks offer both fixed and variable structures, each with its own advantages.

Fixed Rate Loans

Predictable monthly payments

Easier long-term planning

Reducing Balance Loans

Lower total interest paid

Payments decrease over time

Choosing the right structure depends on income stability and financial goals.

Using Financial Planning to Improve Approval Chances

Applicants who approach loan applications strategically have higher success rates. Proper planning shows banks that the borrower understands financial responsibility.

Effective planning includes:

Reviewing monthly expenses

Limiting credit card usage

Maintaining emergency savings

Banks are more confident approving loans for applicants with structured financial habits.

Loan Eligibility for Families and Dependents

Applicants supporting families are assessed differently due to higher monthly expenses. Banks consider:

Number of dependents

Housing costs

Education expenses

While having dependents does not disqualify applicants, it may influence approved amounts and repayment periods.

Common Myths About Personal Loan Eligibility

Many borrowers believe misinformation that affects their decisions. Clarifying these myths helps applicants apply with confidence.

Common myths include:

High salary guarantees approval

Only citizens qualify for large loans

Changing jobs automatically disqualifies applicants

In reality, eligibility depends on a balanced assessment of multiple financial factors.

Frequently Asked Questions (FAQs)

Q1: What is the minimum salary required for a personal loan in Kuwait?

The minimum salary varies by bank, but applicants must earn enough to cover monthly installments while maintaining an acceptable debt ratio.

Q2: Can expatriates apply for personal loans in 2025?

Yes, expatriates can apply, provided they meet residency, employment, and income requirements set by banks.

Q3: Does changing jobs affect loan eligibility?

Yes, frequent job changes may reduce eligibility, especially if employment duration is short.

Q4: Is credit history mandatory for loan approval?

A strong credit history significantly improves approval chances, while negative records may limit options.

Q5: Can loans be approved without salary transfer?

Some banks allow this, but eligibility conditions are usually stricter and interest rates higher.

Final Thoughts on Personal Loan Eligibility in Kuwait

personal loan eligibility in kuwait, Understanding personal loan eligibility in Kuwait for 2025 empowers borrowers to make confident financial decisions. Eligibility is not based on a single factor but on a complete financial profile that reflects income stability, responsible behavior, and repayment capability.

Applicants who prepare in advance, manage their finances wisely, and choose realistic loan amounts significantly improve their chances of approval. Rather than rushing into applications, taking time to understand bank requirements leads to better outcomes and long-term financial stability.