Have you ever wondered why activating Al Rajhi Bank services feels like the first and most important step in starting a secure digital banking journey? Many new customers find themselves unsure where to begin, especially when online banking keeps expanding every year. With so many features available, understanding the activation process can make your financial life much easier right from the start.

Today, digital banking is becoming essential for almost everyone who manages money or sends payments. That’s why knowing exactly how to activate your account, app, and card is more important than ever. Whether you’re registering for the first time or returning to update your details, you’ll find that the process is simpler than it looks. Even major banks across the region continue enhancing their online services, as shown in articles such as Al Rajhi Bank Services & Account Setup, which highlights the expansion of modern banking solutions

But what makes the activation process such a vital step in banking? It’s the gateway to full access. Without activation, you can’t make transfers, receive payments, use your card properly, or enjoy mobile banking features. That’s why this guide walks you through each step clearly, helping you activate your account quickly and confidently.

Understanding the Importance of Activating Al Rajhi Bank Services

Why Account Activation Matters

Account activation ensures that every customer gains secure entry into the banking ecosystem. It verifies your identity, protects your financial information, and enables you to use essential banking tools.

Benefits of Secure Digital Banking

Once your activation is complete, you gain access to mobile banking, online transfers, card services, and secure shopping. Modern banks, including other leading institutions, such as top digital banking services.

Requirements Before Activating Your Al Rajhi Bank Account

- Personal Identification Documents

Make sure you have your national ID or residency card ready. This is the primary requirement for completing the activation process.

- Mobile Number Verification

Your mobile number must be registered under your name for security purposes. It will be used for OTP (One-Time Password) verification.

- Preparing Your Digital Banking Information

Create a strong, memorable password and ensure your device has a stable internet connection.

Steps to Activate Your Al Rajhi Bank Account Online

- Accessing the Digital Activation Portal

You can begin activation through the official online portal and follow the instructions displayed step by step.

- Identity Verification Steps

You’ll be asked to confirm your personal information and enter a verification code sent to your phone.

- Completing Your Online Activation

After identity confirmation, your account becomes fully active and ready for use in the app or on the website.

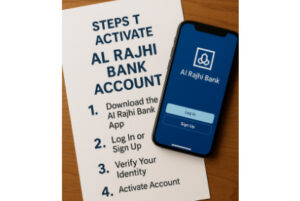

Activating the Al Rajhi App for Mobile Banking

- Downloading and Installing the App

Install the Al Rajhi mobile app from your device’s official store.

- Registering for the First Time

Enter your account number, ID number, and verification code to set up your profile smoothly.

- Troubleshooting Login Issues

If you face issues, check your internet connection or reset your password through the recovery page.

Activating the Al Rajhi Card Securely

- ATM Activation Steps

Insert your card into any Al Rajhi ATM and follow the activation steps on the screen.

- App-Based Card Activation

You can also activate your card directly from the mobile app in the “Cards” menu.

- Security Tips

Choose a PIN that’s not easy to guess and never share it with anyone.

Common Problems During Account Activation and How to Solve Them

- Verification Code Errors

One of the most common issues customers face during activating Al Rajhi Bank services is the delay or failure in receiving verification codes. This usually happens due to network interruptions or an unregistered mobile number. Always ensure your number is updated and linked correctly. If problems continue, restarting your phone or switching to a stronger network often solves the issue.

- Incorrect Personal Information

Sometimes activation fails because small details, such as your date of birth or identification number, are entered incorrectly. Make sure all information matches official records. Double-checking saves time and avoids repeated activation attempts.

- Technical Issues

Slow internet or server delays can stop your activation progress. Try switching devices or connecting to a more stable network. Even other banks that offer modern digital services, such as advanced Islamic banking features,

Comparison: Al Rajhi Activation vs Other Digital Banks

- Activation Time

Al Rajhi Bank is known for its fast activation process. Compared to some digital banks, which take several hours to verify identity, Al Rajhi usually completes activation within minutes. This makes it one of the most efficient systems in the region.

- User Experience

The interface is clean and simple, allowing customers to move through activation steps quickly. Similar banks, such as leading GCC banking platforms, also focus on improving user experience, but Al Rajhi’s system remains among the easiest to follow.

- Digital Features

Activating Al Rajhi Bank. Once activation is complete, customers gain access to transfers, card services, investment tools, and savings accounts. Compared to similar banks, Al Rajhi offers broader digital services and more frequent updates.

Real-Life Case Study: A Customer’s Activation Journey

- Initial Setup

A new customer begins by gathering required documents such as the ID card and phone number. After entering basic account details, they proceed to verify their mobile number.

- App Activation

Next, they download the Al Rajhi mobile app and follow the registration steps. They receive an OTP, create a strong password, and secure their account settings.

- Completing Full Digital Access

After activation, the customer can instantly start using banking services, including transfers, bill payments, and card activation. The entire process takes less than 15 minutes.

Tips for Faster and More Secure Banking Activation

- Password Best Practices

Make sure your password is long, unique, and not similar to passwords you use on other sites. A strong password protects your account from unauthorized access.

- Avoiding Common Mistakes

Activating Al Rajhi Bank: Avoid entering incorrect information and double-check your mobile number. Keep your phone charged and connected to a stable network before beginning the activation process.

Internal Banking Services You Can Use After Activation

- Transfers and Payments

Once activation is complete, customers can make local and international transfers, settle bills, and manage recurring payments easily through the app.

- Card Services

You can activate, freeze, replace, or manage your card from the app. Card control settings make it safer to shop online or in-store.

- Investment and Savings Options

Customers can open investment portfolios, create savings accounts, or explore market opportunities directly from the digital banking dashboard.

External Resources to Improve Your Financial Knowledge

Understanding banking terms and financial security concepts makes using digital banking safer and easier. You can rely on trusted financial resources that explain concepts clearly, such as reliable economic knowledge platforms.

Frequently Asked Questions (FAQ)

1. How long does it take to activate an Al Rajhi Bank account?

Activation usually takes a few minutes once all information is entered correctly, and your mobile number is verified.

2. Can I activate my Al Rajhi card without visiting a branch?

Yes, you can activate your card using the mobile app or any Al Rajhi ATM.

3. What should I do if my verification code doesn’t arrive?

Make sure your phone number is active and registered under your name, then request a new code.

4. Do I need the Al Rajhi mobile app to complete activation?

The app is not required for the initial activation, but it’s essential for accessing full digital banking services.

5. What happens if I enter incorrect information during activation?

The process may fail. Double-check your ID number and personal details, then start again.

Conclusion

Activating Al Rajhi Bank services is the gateway to a fast, secure, and modern banking experience. Whether you’re opening your first account or upgrading to digital services, completing the activation process ensures you can access transfers, card controls, bill payments, and advanced financial tools with ease. By following the steps outlined in this guide, you’ll be able to activate your account, app, and card quickly and confidently.

Activating Al Rajhi Bank Take control of your banking experience today and explore your full range of digital options. Start activating your services now to enjoy seamless, secure, and convenient banking anytime, anywhere.